How incumbent automakers are fueling Tesla’s profitable growth

26 May 2020

The longer traditional auto OEMs wait to launch EVs, the faster Tesla will grow revenues and market share

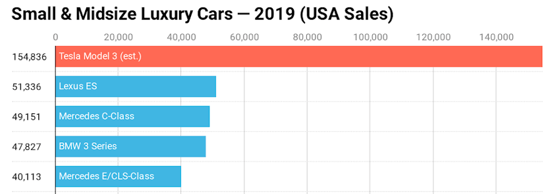

We are living in the electric vehicle age. It is not coming at some point in the distant future; it is upon us now. If you need convincing, look no further than the hundreds of new EV model introductions planned in the next couple of years, or the aggressive fleet electrification targets announced by OEMs and required by regulators. In the race for EV dominance, any observer will agree that Tesla leads by a country mile, while most legacy automakers struggle to catch up (never mind keep up). Much has been made of Tesla’s stock price and whether its astronomical valuation is justified, but the fact is that as of this writing Tesla is worth roughly the same as VW, GM, Ford, and FCA combined. If you’re looking for something more concrete, consider that in 2019, for the small-to-midsize premium car category for the US market, the Tesla model 3 outsold its next three competitors combined (Lexus ES, Mercedes C-class, BMW 3-series).

Source: CleanTechnica

As much as we are already in the electric vehicle age, we are also living through the COVID-19 pandemic and its associated economic fallout. The EV ecosystem has not been spared, with many major OEMs announcing program delays in recent days. (Though some visionary organizations have found ways to keep their battery programs rolling along). Meanwhile, Tesla continues to post impressive results and gain market share. If the rest of the auto industry wants to have any hope of closing the gap, traditional auto OEMs need to make serious investments in their EV programs, or they’ll be left behind.

Tesla profits fueled by...regulatory credits?

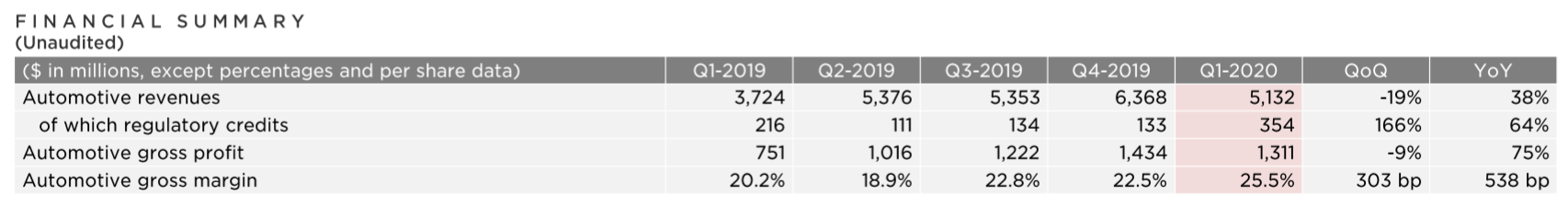

During the first quarter of 2020, even as economic headwinds began to blow, Tesla announced, its first-ever positive quarterly net income. Total revenue grew 32% year over year and gross margins reached the highest level in 18 months. Tesla Q1 automotive revenues were down relative to Q4 2019, but automotive gross profit increased 75% year over year. The most shocking figure in the Tesla financial summary below is the 166% quarter-over-quarter increase of revenues from regulatory credits. Despite unplanned factory shutdowns and slower than expected car sales, Tesla came out on top for the first quarter 2020 and they have legacy automakers’ purchases of emissions credits to thank for that.

Source: Tesla Q1 2020 earnings call materials

Even if the rest of the industry starts sprinting to catch up, Tesla’s titan position in the EV market sustains. During the Q1 earnings call, Tesla reported that the new Model Y, a smaller and more nimble version of the Model X, has already turned a profit. For years electric vehicle production has operated at a loss, much to the dismay of executives. In fact, McKinsey stated that “[electric] vehicles often cost $12,000 more to produce than comparable vehicles powered by internal-combustion engines in the small- to midsize-car segment and the small-utility-vehicle segment.” Tesla’s profit is attributed to two things: 1) a profitable electric vehicle, and 2) selling regulatory emissions credits to its competitors. The fact that Tesla was able to produce a profitable electric vehicle is a complete game-changer, and the Model Y might not be an anomaly. Munro & Associates, a manufacturing and engineering consulting firm, predicted that the Cybertruck could be another profitable vehicle for Tesla - all because it does not require a paint job! They are getting better and better at it with each new model introduced.

Even before COVID-19, Fiat Chrysler and General Motors purchased credits from Tesla to comply with emissions regulations. In 2018, Tesla sold $420 million worth of credits to automakers. Yes, that is $420 million taken from competitors’ profit margins and deposited on Tesla’s balance sheet. Amazingly, in 2019 that figure increased to $594 million of regulatory credit revenue – a 41% increase over 2018. Even more staggering, Tesla had already been collecting regulatory credit revenue from automakers since 2010, to the tune of over $2 billion in total. If Q1 2020 is any indication, the rest of the year will see Tesla continue to collect free cash from the rest of the industry, fueling their profits while everyone else plays catch-up. Indeed Tesla may have a better 2020 than any other global automaker as they build and sell new EV models profitably while siphoning cash from competitors in the form of regulatory credit sales.

What is the rest of the industry doing about it?

To stanch the bleeding of cash and market share, traditional automakers have devoted significant capital and resources to their own electrification programs. In March, General Motors publicly announced a $20 billion investment in electric vehicles. Similarly, Volkswagen CEO has asserted that “it’s an open race” and that they can catch up to Tesla with their investment into EVs. With COVID-19, we are seeing major setbacks in automakers’ electric vehicle plans: Ford has delayed the Mustang Mach-E, General Motors has delayed the GMC Hummer, Rivian announced both the delay of their R1T electric truck and the scrapping of the joint partnership with Ford to develop vehicles under the Lincoln brand. With the logistical and economic disruptions brought by COVID-19, more delays will be no surprise. Before COVID-19, incumbents announced new “Tesla-killer” product lines, but today finds many of those programs on hold as automakers are just trying to stay afloat and survive.

Despite the growing pressure, automakers remain steadfast in their spoken commitments to electrification. Daimler CEO, Ola Kallenius said that “[Daimler is] continuing to invest in key technologies, including electrification and digitalization. They are non-negotiable elements of our future.” And that’s not surprising. The plan to deploy electric vehicles is not an initiative that executives think will bring short-term gains. It’s quite the opposite: these are multi-year projects that require an enormous amount of capital, resources, and plans to boost automakers into the next phase of battery-powered growth. During a conference with the Financial Times, Volvo CEO Håkan Samuelsson said, “electrification will go faster. I think it would be naive to believe after some months, everything will return to normal, and our customers will come back into a showroom asking for diesel cars. They will ask even more for electric cars. And that is speeding up.” If global automakers remain serious about electrification, the best thing they can do now is invest strategically (now!) in programs that will help to accelerate their EV progress so they can finally catch up to Tesla.

The future is now — it’s time to invest.

As we mentioned in our latest blog post on recession-proofing battery programs, Voltaiq is the industry leader in Battery Intelligence with a proven track record of bringing cutting-edge battery analytics to our customers. Automakers on the forefront of innovation have been using Voltaiq to ship electric vehicles on time. With COVID-19, our customers are using Voltaiq to drive their battery programs forward, even while practicing shelter-in-place. In fact, our customers are able to meet their product launches because they are using a battery analytics platform designed to accelerate product development. The Battery Intelligence platform was built to help automakers launch their electric vehicles, from cell qualification to validation, to pack design, to manufacturing, and tracking that battery in use during operations. Incumbent automakers can either compete in (and win!) this race by deploying performant electric vehicles on time with the help of Voltaiq, or they can continue to purchase regulatory credits from Tesla and concede further market share.

Earlier this week, Bloomberg New Energy Finance published their annual Electric Vehicle Outlook and the BNEF team predicts that by mid-2020s, electric vehicles will reach price parity with internal combustion vehicles. That’s five years away. As we discussed earlier, electrification programs are multi-year projects, meaning now is the time to invest strategically into resources that will propel your competitive advantage forward. Now is the time to invest in a Battery Intelligence platform that will catapult your battery program and make your vehicle the standout product that Tesla will have to beat.